Payroll services in France – Maternity leave

Maternity and paternity leave in France When employees are expecting the birth of a child, naturally they would want to know how their…

Register as foreign employer

Employ and run payroll internationally without setting up a foreign company We often get the question from companies if they need to set up…

How to get a social security number in France

Social security number – a key for compliant payroll in France If you are recruiting a new employee, he or she must provide you with a…

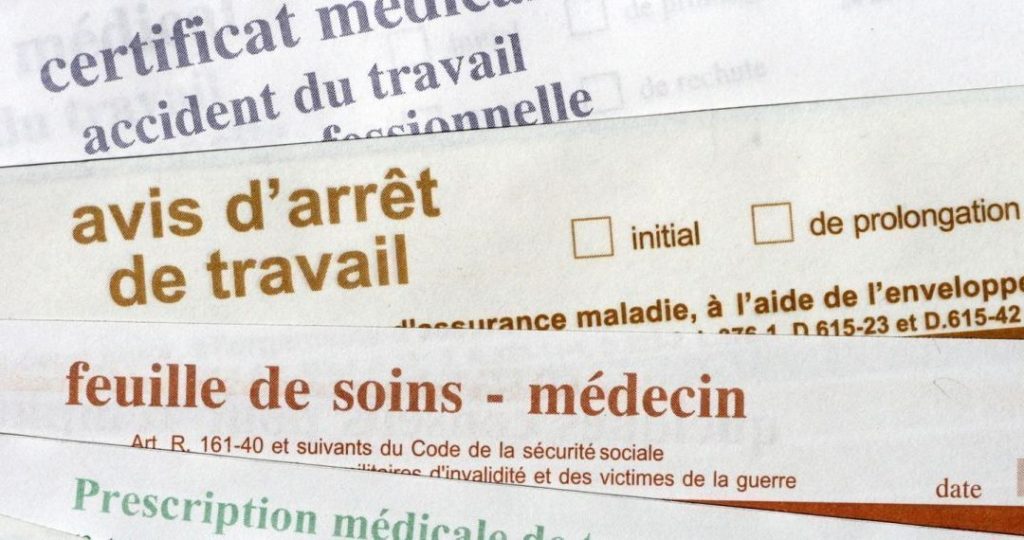

How to administrate sick leave in France

Internago has summarised the procedures for when an employee needs to leave work because of illness. The sick leave document bundle for each…

Solidarity day – how it affects your payroll services in France

Internago French payroll team often gets the question about the “Solidarity day”. Below we have summarised a practical factsheet, and how it…

Payroll and business related measures in Italy during the COVID-19 crisis

In order to cope with COVID-19, the Italian government has prepared a comprehensive package for companies, that affect the payroll services…

Payroll and business related measures in the Netherlands during the COVID-19 crisis

Due to the COVID-19 emergency, the Dutch government has introduced the so called “NOW-regulation”. The regulation primarily focuses on…

Payroll and business related measures in Sweden during the COVID-19 crisis

To mitigate the financial consequences of Covid-19, the Swedish state has taken several important financial measures. Internago has…

Payroll and business related measures in France during the COVID-19 crisis

Due to the COVID-19 outbreak, the French state has planned a number of measures to support French companies and self-employed. Internago has…

New regulations for 2020 affecting your business activities in Sweden

The new year brings some important changes regarding the payroll in Sweden. Internago has put together a brief overview of the most…