Did you know that France has some of the most extensive payroll regulations in Europe? Navigating these regulations can be challenging (see blog about outsourcing French payroll), especially for international businesses. With changes made every year to improve working conditions, staying compliant is crucial to avoid costly fines and legal disputes.

Our blog is your go-to resource for staying informed about the latest changes in French payroll regulations. We provide valuable insights to help your business navigate compliance effortlessly. Trust Internago to keep you informed and compliant, ensuring the well-being of your employees, both in France and internationally.

Stay Updated on Wages and Paid Time Off

This year, significant changes are impacting French payroll regulations, from minimum wage adjustments to updates on sick leave policies.

- Minimum wage: The gross minimum income increased to €1,766.92.

- Sick Leave: A new law grants two working days per month for non-work-related sickness and two and a half days for job-related sickness. Unused paid time off due to sick leave can now be reported for up to fifteen months.

- Association Commitment Leave: Conditions for public agents to take six days of association commitment leave have been relaxed. Employees can now donate unused leave days to associations in monetized form.

- Miscarriage Leave: Women who miscarry are entitled to sick leave without a waiting period, ensuring immediate indemnities.

Keeping Up with Contributions

Understanding contributions is essential when preparing payslips. France’s social protection system is funded through contributions from both employees and employers. This year, some rates have evolved.

- Retirement Contributions: “Cotisations Vieillesse” rates are 2.42% for unlimited contributions, split between employer and employee, and different rates for salaries below the social security ceiling (€3,864 per month).

- Health Insurance Contributions: “Cotisations d’assurance maladie” rates are 7% for annual wages under €52,2416 and 13% above that amount.

Benefits and Deductions

French employees receive “ticket restaurants” for meals, partially covered by employers. In 2024, employers are exempt from social security contributions for meal vouchers up to €7.18.

Simplifying Payroll for All

Since January 1, 2024, new sections like “montant net social” have been added to payslips, showing the employee’s income after social contributions. This helps those applying for social welfare benefits like the “Revenu de solidarité active” (RSA).

Protecting Employees

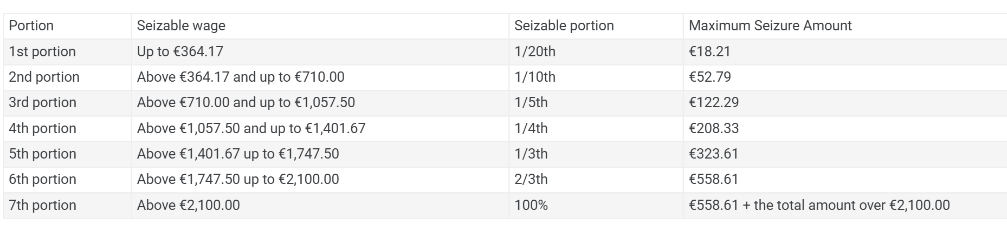

Each year, the “barème de saisie sur salaire” (salary garnishment scale) is updated. This scale is designed to protect a portion of an employee’s salary from being garnished to pay off debts, ensuring they retain enough income for essential living expenses. The amount that can be garnished depends on your monthly wage and personal circumstances. Here is the current scale for individuals without a partner or

children:

For example, someone earning €2,000 a month would fall into the 6th portion. €491.94 of the salary can be garnished.

You can check how much of your wage is sizable on the French government website.

Looking Ahead

The French government plans to simplify payslips by 2027, focusing on mandatory contributions. By 2030, an online platform for businesses will be created to facilitate the updating and transmission of information to the administration.

Conclusion

Staying aware of payroll regulations is crucial for international businesses. Recent changes highlight the dynamic nature of payroll management. Compliance ensures the well-being of employees and protects your business from legal and financial risks.

Keep calm and let Internago handle your payroll. With us, compliance is assured. To stay informed on international payroll regulations, visit our website and payroll portal. Contact us at info@internago.com. For more insights on the French job market, check out our previous blog on salary costs in France.